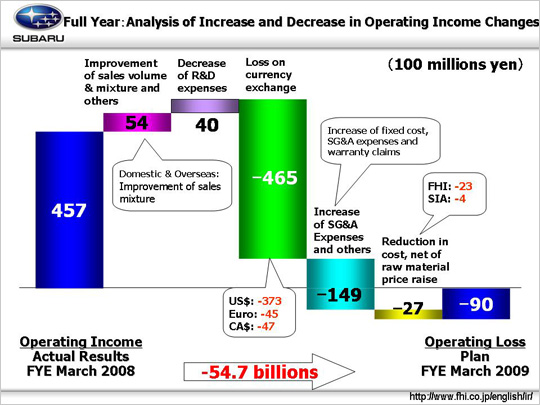

| Reasons for the change from 45.7 billion yen in operating income to a 9 billion yen operating loss: First, a factor raising income will be an increase of 5.4 billion yen due to improvement of sales volume and mixture. This is comprised of three parts: (1) In Japan, a 10.9 billion yen decrease. (2) Overseas, a 3.9 billion yen increase. (3) An increase of 12.4 billion yen in others. An increase of 4 billion yen (52 billion yen The primary factor for decreased income is a 46.5 billion yen due to loss on foreign currency exchange, with a loss of 37.3 billion yen based on a 15 yen appreciation against the U.S. dollar, a loss of 4.5 billion yen based on a 15 yen appreciation against the Euro, and a loss of 4.7 billion yen based on a 17 yen appreciation against the Canadian dollar. A decrease of 14.9 billion yen due to an increase in overhead costs, etc. This is comprised of three factors: (1) A decrease of 9.4 billion yen due to increased fixed manufacturing costs (-10.4 billion yen at Fuji Heavy Industries, +1 billion yen at SIA). FHI will have increased fixed processing costs at -5.7 billion yen and increased cost of suppliers' dies of -4.7 billion yen. At SIA (+$9M), labor costs etc. are expected to be compensated for by decreased cost of suppliers' dies and depreciation expenses (decreased cost of suppliers' dies +$24M, less depreciation +$3M, increased labor costs -$11M, increased expenses -$7M). (2) A decrease of 2 billion yen due to an increase in SG&A expenses. SG&A fell at FHI (+6.3 billion yen) and at domestic dealers (+0.2 billion yen). However, they increased by 0.4 billion yen SOA due to higher advertising costs {-US$3M. (+US$7M due to reduced incentives, -US$10 due to advertising costs and etc.)} In Canada, a decrease of 1.4 billion due to an increased SG&A expenses, etc. In others, a decrease of 6.7 billion yen. (3) A decreased of 3.5 billion yen due to increased costs associated with warranties. A decrease of 2.7 billion yen due to reduction in cost and raw material price raise, of which -2.3 billion yen is for FHI, and -0.4 billion for SIA. Higher raw material prices are expected to have a -20.9 billion yen impact, with -16.8 billion yen at FHI, and -4.1 billion yen at SIA. (Material cost reduction of 18.2 billion yen, of which 14.5 billion yen is for FHI, and 3.7 billion yen for SIA) Accordingly, a 54.7 billion yen decrease in operating income is planned. |