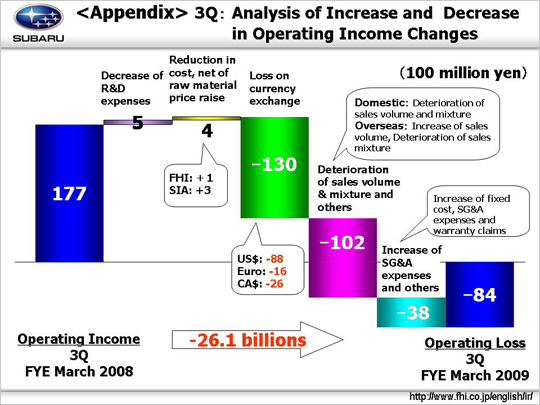

| Reasons for the change from operating income of 17.7 billion yen to operating loss of 8.4 billion yen: The main factor which raised income was an increase of 0.5 billion yen due to decreased research and development expenses. This was due to a temporary completion of new model development and work to rationalize advanced development. Material cost reduction brought about increase of 0.4 billion yen, of which 0.1 billion yen was for FHI, and 0.3 billion yen for SIA. Included in this was a decrease of 4.4 billion yen (of which -3.7 billion yen for FHI, and -0.7 billion yen for SIA) in increased raw materials' prices due to the so-called worsening steel materials and market conditions (Gross material cost reduction of 3.8 billion yen for FHI, and 1 billion yen for SIA). On the other hand, a factor decreasing income was a 13 billion yen loss on currency exchange. -8.8 billion yen on an approximately 13 yen appreciation against the U.S. dollar, -1.6 billion yen on an approximately 25 yen appreciation against the Euro, and -2.6 billion on an approximately 29 yen appreciation against the Canadian dollar. There was a 10.2 billion yen decrease due to the deterioration of sales volume & mixture. This was comprised of three factors: (1) In Japan, a 7.6 million yen decrease due to sales volume decrease of Legacy, Impreza, and minicars. (2) Overseas had an increase of 2.9 billion yen. Sales volume increased, but the mix was deteriorated. (3) Inventory adjustment etc. resulted in -5.5 billion yen. A decrease of 3.8 billion yen based on an increase of SG&A expenses and others. This was comprised of four factors: (1) a decrease of 2.5 billion yen due to increased fixed manufacturing costs (FHI -2.8 billion yen, SIA +0.3 billion yen). (2) A decrease of 2.2 billion yen due to increased SG&A expenses. SG&A decreased 0.1 billion yen for FHI, increased 1 billion yen for domestic dealers, -1.4 billion yen for SOA, increased 0.5 billion for SCI, and decreased 2.2 billion yen for others. (3) A decrease of 0.1 billion yen due to in increase in costs associated with warranties. (4) the remaining increase of 1 billion yen is the subsidiaries' procurement forex adjustments. Accordingly, income decreased by 26.1 billion yen. |