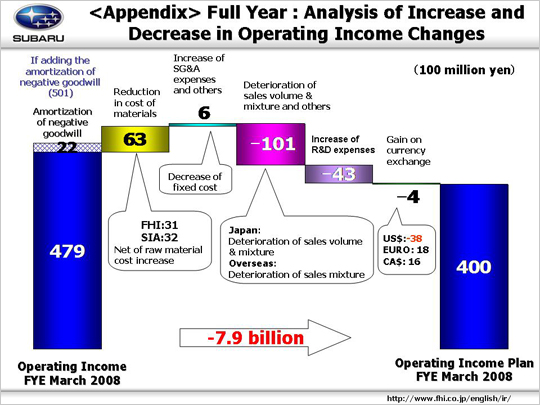

| The operating income is expected to decrease to 40.0 billion yen from 47.9 billion yen. The reasons for changes in operating income are as follows: Material costs will decrease by 6.3 billion yen, 3.1 billion yen at FHI and 3.2 billion yen at SIA. This figures includes higher priced raw materials which are expected to lead to a 9.8 billion decrease. Increase of SG&A expenses and others will add 0.6 billion yen. This can be broken down into four parts. First, (1) increased fixed manufacturing costs reduced income by 5.6 billion yen (-7.5 billion yen at FHI and +1.9 billion yen at SIA), with increased fixed processing costs (-4.0 billion yen) and suppliers’ die cost (-3.5 billion yen) at FHI and lower depreciation costs at SIA. (2) Lower SG&A expenses are projected to increase income by 1.3 billion yen with a 0.6 billion yen domestic increase. An increase in expenses such as advertisement costs at FHI is forecasted (-0.7 billion yen) and a decrease in SG&A at dealerships (1.3 billion yen) is anticipated. Overseas companies will show 0.7 billion yen increase, with a 2.1 billion yen decrease due to a planned $200 incentive decrease per unit at SOA compared with the previous fiscal year. Increased SG&A expenses at overseas subsidiaries will result in -1.4 billion yen. (3) A decrease in cost associated with warranty will result in 2.8 billion yen increase. (4) The remaining 2.1 billion yen is due to other factors. A loss in profit due to the deterioration of sales volume and mixture of -10.1 billion yen is anticipated. This can be broken down into three parts. (1) A decline in the volume of Legacy and minicars will lead to a 16.3 billion yen loss in the domestic market. (2) The overseas market is expected to bring +0.5 billion yen. There are plans to increase sales volume but the product mixture is forecasted to deteriorate. (3) Factors such as inventory adjustments will bead to +5.7 billion yen {unrealized inventory 1.1 billion yen (-0.5 billion yen in Japan, +1.6 billion yen overseas), and other items (4.6 billion yen)}. Also, a higher R&D will lead to -4.3 billion yen (50.7 billion yen to 55.0 billion yen). Multi-passenger vehicles, a full model change for Legacy and other cars, and environmental countermeasures will move ahead. A 0.4 billion yen exchange rates loss is forecasted, including a 3.8 billion yen loss from 2 yen-rise against the US dollar, an 1.8 billion yen gain from an approximately 11 yen-rise against the Euro, and a 1.6 billion yen gain in FHI exports to Canada due to an approximately 8 yen-rise against the Canadian dollar. Based on the above facts, operating income is estimated to decrease by 7.9 billion yen. |