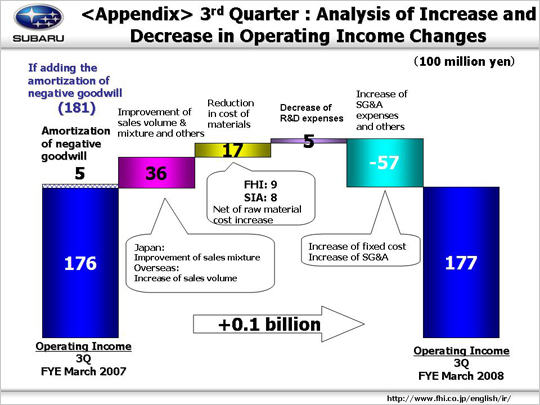

| Operating income increased from 17.6 billion yen to 17.7 billion yen. Gain factors; Improvement of sales volume and mixture that resulted in a 3.6 billion yen increase. This was broken down into three parts. 1) Domestically we suffered a loss of 0.8 billion yen. Sales volume decreased, though the introduction of the Impreza WRX STI improved the sales mixture. 2) Overseas markets saw a loss of 0.9 billion yen. In spite of a growth in sales units, the sales mixture was still deteriorating because new models had not yet been fully launched. 3)Other factors including inventory adjustments of 5.3 billion yen {+0.7 billion yen of unrealized inventory (-0.5 billion yen in Japan, +1.2 billion yen overseas), higher profits for parts, used cars and other items(4.6 billion yen)}. Reduction in material costs added 1.7 billion yen, with 0.9 billion yen from FHI and 0.8 billion yen from SIA, including a 2.1 billion yen rise in raw material prices due to a hike steel material price and worsening market conditions. R&D costs decreased due to the completion and streamlining of first-stage development for the new Impreza and Forester, leading to an additional 0.5 billion yen profit. On the other hand, factors such as increased SG&A expenses and others decreased income by 5.7 billion yen. This was broken down into four parts. First, (1) Higher fixed manufacturing costs decreased income by 1.1 billion yen (-1.5 billion yen for FHI, +0.4 billion yen for SIA). (2) Increased SG&A expenses decreased income by 3.2 billion yen. In Japan, SG&A expenses remained at roughly the same level as the previous year (-0.1 billion yen for FHI, 0 yen for dealerships) but overseas expenses rose approximately 3.0 billion yen. Although SOA (-1.2 billion yen) cut expenses such as advertisement costs by 1.0 billion yen and saw a moderate increase in incentives on a year-to-year basis (-2.2 billion yen in total, increased from $1,100 to $1,400 per vehicle), other overseas businesses were increasing expenses such as advertisement costs (-1.9 billion yen). (3) Costs associated with warranty decreased 0.5 billion yen, for a favorable impact. (4) The remaining 1.9 billion yen income reduction stemmed from other factors, including a 1.7 billion yen drop from exchange loss on foreign currency. The above factors increased operating income by 0.1 billion yen. |