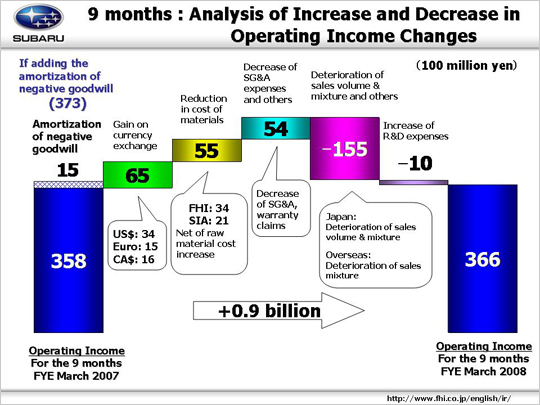

| Now moving on to the reason for the change in operating income from 35.8 billion yen to 36.6 billion yen. A gain on the currency exchange added 6.5 billion yen to operating income. A 2-yen depreciation against the US dollar added 3.4 billion yen, while a 16-yen depreciation against the Euro added 1.5 billion yen. Also, a 9-yen depreciation against the Canadian dollar yielded 1.3 billion yen through Fuji Heavy Industries Ltd.(FHI) exports to Canada, and the strong $CA/$US rate added 0.3 billion yen from Subaru of Indiana Automotive Inc.(SIA) exports to Canadian subsidiary for a total increase of 1.6 billion yen. There was a 5.5 billion yen reduction in material costs, 3.4 billion yen from FHI and 2.1 billion yen from SIA, including a 7.6 billion yen rise in raw material prices due to the hike of steel material price and worsening market conditions. A decrease of SG&A and other expenses added 5.4 billion yen. This can be broken down into four parts. (1) an increase in fixed manufacturing cost led to a -2.1 billion yen (-4 billion yen for FHI and +1.9 billion yen for SIA), with increased suppliers’ die cost (-1.7 billion yen) and fixed processing costs (-2.3 billion yen) at FHI, while increased suppliers’ die cost (-$9M) that caused lower income were compensated by lower depreciation costs (+$15M) and decreased labor cost (+$11M) at SIA. (2) Lower SG&A expenses increased income by 5.1 billion yen. Lower SG&A expenses in Japan added 2.5 billion yen to income, with +1.1 billion yen from FHI, and +1.4 billion yen from dealerships in the first half. Due to an expected increase in advertising costs in the 4th quarter, higher SG&A expenses are forecasted. Overseas markets saw an increase of 2.6 billion yen with +4.9 billion yen from Subaru of America Inc.(SOA) and -2.3 billion yen in other businesses overseas. A $330 decrease in per-vehicle incentive was significant (+$34M) and advertising costs and other costs were reduced (+$9M). (3) A decrease in costs associated with warranty brought a 2.8 billion yen increase. (4) The remaining -0.4 billion yen stems from the net exchange gain and loss on foreign currency. On the other hand, deterioration of sales volume and mixture reduced profit by 15.5 billion yen. This can be broken down into three parts. (1) A domestic decline in the volume of Legacy and minicars resulted in -14.7 billion yen loss. (2) There was an overseas loss of -5.9 billion yen. Although sales volume was increased, the mixture was deteriorated. (3) Other factors include inventory adjustments of 5.1 billion yen {+0.9 billion yen of unrealized inventory (-0.3 billion yen in Japan, +1.2 billion yen overseas), higher profits for parts, used cars, and other items (4.2 billion yen)}. Also, a higher R&D resulted in -1 billion yen (37.3 billion yen to 38.4 billion yen). This is due to higher R&D for the planned introduction of multi-passenger vehicles and a full model change for the Legacy and other cars. The above shows a 0.9 billion yen increase in operating profit. |