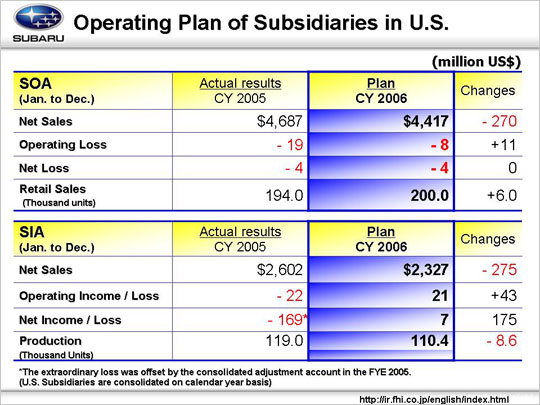

Despite increased retail sales for the robust Impreza, net sales for SOA are projected to decrease by $270 million from the previous year due to inventory adjustment by dealers focusing on the B9 Tribeca. Operating loss is projected to decrease overall by $11 million to -$8 million due to a repositioning of MSRP in line with competition in the U.S. market, despite factors leading to a profit decrease such as deterioration of sales volume and mix caused by inventory adjustment of the B9 Tribeca and increased incentives from $1,450 in 2005 to $1,800 in 2006 following the 06MY sell-off. SIA is anticipating a drop in revenue of $275 million due to a decrease in production volume for the North American market, despite the initiation of exports of the B9 Tribeca to Europe and Australia. At the profit level, forecasted operating losses of $23 million in reduced sales volume and $30 million due to the effects of increased raw materials cost are expected to be offset by such positive factors as the results of total cost reduction measures ($68 million) and $12 million in general cost reductions (labor and overhead costs $4 million, depreciation $9 million, die’s depreciation -$7 million, other $6 million), in addition to improved sales price mix ($16 million). This all relates to a projected increase of $43 million to $21 million in operating income. Net income is expected to total $7 million, with a profit increase of $175 million due to the write-off of extraordinary losses (approximately $196 million) generated from the termination of consignment production in 2005. |