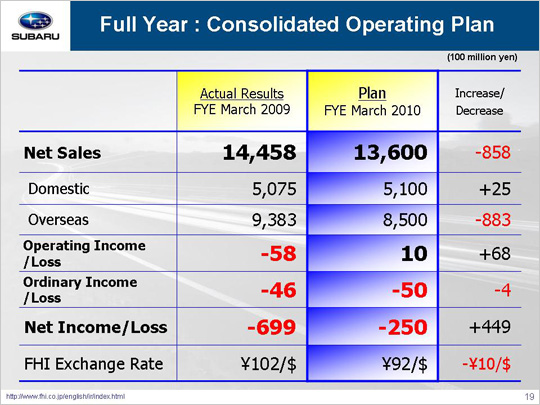

We revised our forecast for the fiscal year ending March 2010 as we watched the results for the first half of this fiscal year exceed our consolidated operating plan targets.

Net overseas sales have been revised upward by 40 billion yen and are projected to fall by only 85.8 billion yen, or 5.9%, to 1,360 billion yen on a year-on-year basis. Consolidated sales volume is projected to rise 37.6 thousand units above our initial forecast, mainly in overseas markets.

Operating income is estimated to increase 6.8 billion yen to total 1 billion yen on a year-on-year basis. Although we expect that the sales volume will fall below last year’s total and that the yen is likely to remain strong, we will make cost reduction efforts with an eye to returning to profitability. Estimated operating income has been revised upward by 36 billion yen (further details will be provided later).

Ordinary income is forecasted to fall below operating income by 6 billion yen, resulting in an ordinary loss of 5 billion yen. This decline is expected to come from a gain of 1 billion yen due to the effects of foreign exchange fluctuations and derivatives, a loss of 4 billion yen due to falling financial revenue and rising expenditures, a gain of 1 billion yen from equity method income, and a loss of 4 billion yen due to other factors. There will be a 0.4 billion yen year-on-year decrease in ordinary income. This reflects an upward revision of 35 billion yen from the initial forecast.

As for net income, we project an extraordinary loss of 2 billion yen on sales and retirement of noncurrent assets, an approximate 1 billion yen loss on abandonment of inventories of the Industrial Products Company, which was posted during the first half of this fiscal year, a domestic dealer-related impairment loss of 6 billion yen, and a loss of 2 billion yen due to other reasons, all of which will result in a pretax loss of 16 billion yen. This combined with tax expenses for our subsidiaries amounting to 9 billion yen will generate a net loss of 2.5 billion yen, resulting in a total 44.9 billion yen year-on-year improvement as we expect to see an improvement as a result of the reversal of the provision of valuation allowance of deferred tax assets during the previous fiscal year. Furthermore, we revised our initial forecast upward by 30 billion yen. |