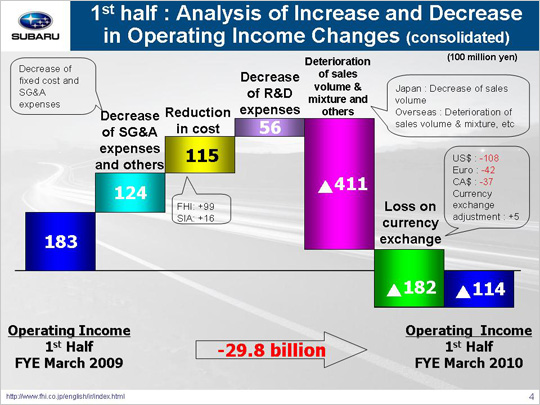

Now moving on to the factors behind the 29.8 billion yen shift in operating income which dropped from 18.3 billion yen operating income to 11.4 billion yen operating loss.

The primary factor for the profit upswing was an increase of 12.4 billion yen due to a decrease of SG&A expenses and others. This amount can be broken down into three areas. (1) An increase of 0.9 billion yen in fixed manufacturing costs (-1.7 billion yen for FHI (Fuji Heavy Industries) and 2.6 billion yen for SIA). This included a decrease in fixed processing costs (1.2 billion yen) and an increase in expenses for suppliers’ dies (-2.9 billion yen) at FHI, as well as decreases in expenses for suppliers’ dies ($24M) and fixed processing costs ($1M) at SIA that resulted in a gain of $25M. (2) The decrease in SG&A expenses resulted in a gain of 14.4 billion yen. This included a gain of 6.7 billion yen at FHI as a result of efforts toward reducing advertising and SG&A expenses. Domestic dealers also worked on cutting SG&A expenses, resulting in a gain of 4.4 billion yen. SOA, however, generated a loss of 1.4 billion yen ($14M) due to increases in advertising expenses and SG&A expenses, which respectively generated losses of $5M and $9M. Although $300 was cut off the $1,600 per-unit incentive for January-June 2008, to bring it down to $1,300 for April-September 2009, the actual incentive cost remained at the same level on a year-on-year basis due to the increased sales volume. Our Canadian subsidiary also reduce 1.7 billion yen of incentive and advertising cost while cost reduction efforts by other subsidiaries also generated a gain of 3 billion yen. (3) An increase in costs associated with warranty claims led to a loss of 2.9 billion yen. We made an allowance for costs associated with warranty claims in overseas markets.

We gained 11.5 billion yen due to a reduction in materials costs, 9.9 billion yen at FHI and 1.6 billion yen at SIA. At FHI, reduction in materials cost was 2.3 billion yen and a gain of 7.6 billion yen after recouping the losses from the previous year’s price hikes for precious metals and other materials. A gain of $15M was generated at SIA, including $3M due to a reduction in materials cost and $12M after recouping the losses from the previous year’s hike in materials prices.

We gained 5.6 billion yen due to a reduction in R&D costs (from 22.8 billion yen to 17.1 billion yen) and are making efforts toward increasing R&D efficiency.

While the loss of 41.1 billion yen can be attributed to the deterioration of sales volume & mixture and others, the factors that led to the downturn in profits can be divided into three areas. (1) Although the declined sales volume for passenger cars and minicars in the domestic market led to a loss of 4.1 billion yen, the sales mix improved thanks to the new car effect of Legacy. (2) In overseas market, we suffered a loss of 25.6 billion yen. This was due primarily to FHI’s production adjustment and reduced shipping volume during the first quarter. (3) We lost 11.4 billion yen due to inventory adjustment and other factors [-9.5 billion yen in unrealized inventory losses (-3.3 billion yen domestically, -6.2 billion yen overseas), -1.9 billion yen due to other factors].

Loss on currency exchange stood at 18.2 billion yen. This includes a loss of 10.8 billion yen due to an appreciation of approximately nine yen against the U.S. dollar, a loss of 4.2 billion yen due to an approximate thirty-yen appreciation against the euro, and a loss of 3.7 billion yen due to an approximate twenty-yen appreciation against the Canadian dollar. This figure included a gain of 0.5 billion yen since foreign exchange adjustments for transactions between FHI and its overseas subsidiaries, which used to be classified as “SG&A expenses and others,” were as the first half of this fiscal year classified as foreign exchange gains/losses. FHI’s sales rate is based on the average rates applied during the previous month and adjusts the difference with its subsidiaries’ purchase spot rates.

These factors combined brought operating income down 29.8 billion yen, resulting in an operating loss of 11.4 billion yen. |