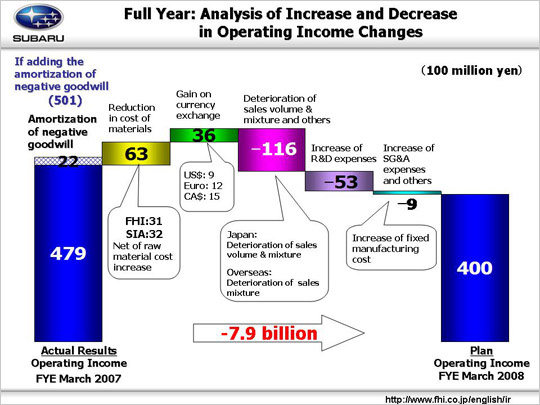

Factors leading to the 47.9 billion yen to 40.0 billion yen decline in operating income include the following:

The primary factor contributing to the increase in operating income is a 6.3 billion yen reduction in cost of materials, 3.1 billion yen at FHI and 3.2 billion at SIA. This includes an estimated increase of 9.8 billion yen in material prices (-6.0 billion yen at FHI, -3.8 billion yen at SIA).

Another factor is a currency exchange gain of 3.6 billion yen. There will be an approximate one-yen depreciation against the U.S. dollar for an estimated gain of 0.9 billion yen and an approximate seven-yen depreciation against the Euro for an estimated gain of 1.2 billion yen. A gain of 1.5 billion yen is projected for shipments from FHI to our Canadian subsidiary due to an approximate seven-yen depreciation against the Canadian dollar.

The major factor contributing to the decrease in operating income is the deterioration of sales volume and mix, which is estimated to be 11.6 billion yen. This amount can be broken down into three areas. (1) Domestic sales will suffer a loss of 16.3 billion yen, primarily due to the declining sales volume for the Legacy and minicars. (2) International sales will see a decline of 1.0 billion yen. Although the sales volume is expected to increase, the sales mix will deteriorate. (3) Inventory adjustments, etc. resulted in an increase of 5.7 billion yen [1.1 billion yen in unrealized inventory gains (-0.5 billion yen in Japan, 1.6 billion yen overseas), 4.6 billion yen for other reasons].

The increase of R&D expenses (from 50.7 billion to 56.0 billion yen) will lead to another 5.3 billion yen drop in profit. We will develop new models including multiple passenger cars and the new Legacy as well as improvement of environmental performance.

The increase in SG&A expenses will lead to 0.9 billion yen losses. This amount can be broken down into four areas. (1) The increase in fixed manufacturing cost will cause a loss of 7.1 billion yen (-9.0 billion yen at FHI, +1.9 billion yen at SIA). FHI will see increases in fixed processing costs (-4.5 billion yen) and suppliers’ die costs (-4.5 billion yen) while SIA will see a decline in depreciation costs. (2) A drop in SG&A expenses will generate a gain of 1.3 billion yen. A 0.6 million yen gain in Japan will result from reduced SG&A expenses at dealers (1.3 billion yen) despite an increase in advertising costs at FHI (-0.7 billion yen). Internationally there will be a gain of 0.7 billion yen. A reduction of $200 in per-unit incentive costs ($31M, from $1,800 to $1,600) will generate a savings of 2.1 billion yen. Increases in SG&A expenses at overseas subsidiaries will lead to a loss of 1.4 billion yen. (3) The decrease in costs associated with warranties will lead to a gain of 2.8 billion yen. (4) There will also be a gain of another 2.1 billion yen for other reasons.

These factors combined should lead operating income to decline by 7.9 billion yen.

|