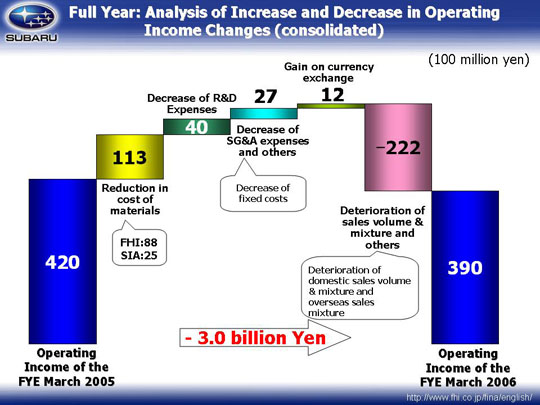

| Causes for the decrease in operating income from ¥42.0 billion to ¥39.0 billion are as follows: Reasons for areas of increase in profits include a reduction in the cost of materials of ¥11.3 billion, of which ¥8.8 billion was seen at FHI and ¥2.5 billion at SIA. R&D costs decreased by ¥4.0 billion (¥53.0 billion to ¥49.0 billion). Overheads should decrease to ¥2.7 billion. A breakdown of this shows fixed manufacturing costs down by ¥5.7 billion. Domestically, depreciation of the dies for the Legacy should fall; however, depreciation of the dies associated with the Legacy and the B9 Tribeca at SIA should increase. SIA is also expected to see increases in sales costs of ¥0.8 billion over the total of last year. Incentives at SOA are forecast to increase by US$100 (US$1,300 to US$1,400), while advertising costs are also predicted to rise year-on-year due to the introduction of the B9 Tribeca. Advertising expenses associated with FHI and domestic dealerships as well as sales incentives are expected to decrease. Also decreases over last year in expenses associated with warranties are expected, after a reversal of the provision for recalls of around ¥4.0 billion. Gain on currency exchange of ¥1.2 billion will be seen differentials for the US$ down by ¥0.3 billion, the euro down by ¥0.3 billion and the Canadian dollar up by ¥1.8 billion. Losses in income will derive from sales mix of -¥22.2 billion, which will consist of -¥15.2 billion domestically and -¥2.7 billion overseas. Specifications are improving for overseas shipments from FHI in terms of safety and environmental requirement; however this is not turning into increased revenue which is leading to costs expected at around ¥11.0 billion. Inventory adjustments will cause a fall of ¥4.0 billion. The above leads to a projected operating income of ¥3.0 billion decrease. |