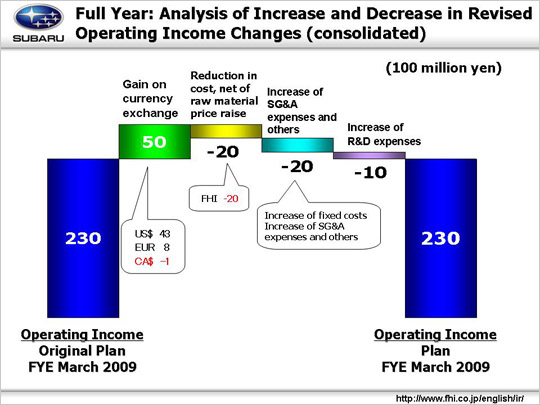

| While previous estimate of 23.0 billion yen operating income is unchanged, factors for increase and decrease were changed. The analysis of these causes is given as follows. On the one hand, as factors for increasing operating income, gain on foreign currency exchange amount to +5.0 billion yen. Taking gain on foreign currency exchange in the first half into consideration, it is estimated that +4.3 billion yen will be gained from the yen weakening by 2 yen in US$ (from 100 to 102 yen), +0.8 billion yen gained from a change of about 3 yen in Euro (from 155 to 158 yen), and 0.1 billion yen less due to a change of 1 yen in Canadian dollar (from 105 to 104 yen). On the other hand, as factors for decreasing operating income, 2.0 billion yen are expected from further rises in raw material prices in FHI, with 1.0 billion yen increased R&D expenses due to environmental issues (from 55.0 billion yen to 56.0 billion yen), and fixed costs and SG&A expenses by 1.0 billion yen each amongst increase of SG&A expenses and others are anticipated. Although overseas sales mixture in FHI will be expected to increase by 2.0 billion yen in the first half of the year, this will be offset in the second half due to the tougher market environment. Due to the above factors, the operating income projection for this fiscal year remains the same as was forecasted at the beginning of the year. |