|

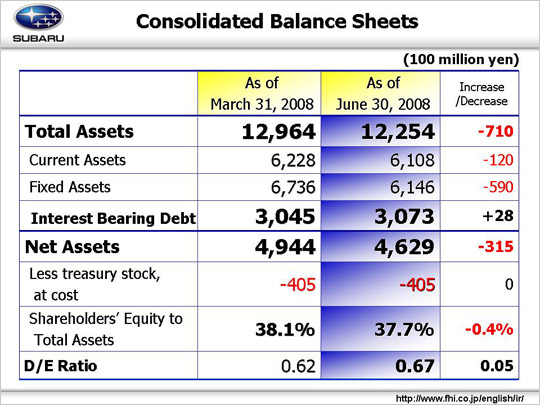

Next up is balance sheets. Total assets were 1 trillion 225.4 billion yen, a decline of 71.0 billion yen from the end of the last fiscal year. This includes an approximately 40 billion yen foreign subsidiary currency translation difference, as the yen appreciated compared to three months ago. Current assets decreased by 12.0 billion yen because of a decrease in cash and deposits, notes and accounts receivable-trade and short-term loans receivable due to seasonal trend, despite an increase from a transfer to lease assets, net to lease investment assets due to changes in accounting for lease transaction. Fixed assets declined by 59.0 billion yen, owing to a decrease in lease assets, net according to changes in accounting for lease transaction, and decreased goodwill as goodwill in overseas subsidiaries was amortized based on Japanese GAAP. Interest bearing debt was almost flat, as the subsidiary Subaru Finance issued 8.0 billion yen of commercial paper, while overseas subsidiaries repaid long-term loans. The debt-to-equity ratio is 0.67. Net assets were 462.9 billion yen in total, down by 31.5 billion yen, as retained earnings decreased due to amortization of goodwill, and the foreign currency translation adjustment account declined. The shareholders' equity to total assets ratio is 37.7%. |