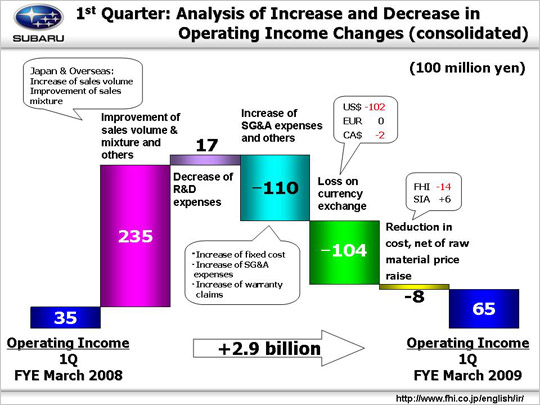

| Here is a detailed analysis of the increase and decrease in operating income from 3.5 billion to 6.5 billion yen. The main reason for the increase in operating income was 23.5 billion yen from the improvement of sales volume & mixture and others. This can be divided in three categories. 1) +1.4 billion yen from Japan. This was contributed by an increase of Forester and Exiga in units, and an improved sales mixture in Forester and Impreza. 2) +10 billion yen from overseas. Particularly, an increase in units shipped by FHI had a large effect. In addition, an improvement of sales mixture in Forester and Impreza compensated for a deterioration of sales mixture in Legacy. 3) +12.1 billion yen from inventory adjustment and others {unrealized inventory +5.9 billion yen (Japan +1.7 billion yen, and overseas +4.2 billion yen) and others +6.2 billion yen. R&D expenses were down by 1.7 billion yen (from 11.4 billion yen to 9.7 billion yen). The main cause of the decrease in operating income was the increase in SG&A expenses and others by 11.0 billion yen. This can be divided in four categories. 1) -4.6 billion yen from fixed manufacturing costs (FHI -4.5 billion yen, and SIA -0.1 billion yen), consisting of -2.8 billion yen from the increase in fixed process costs in FHI, and -1.7 billion yen from suppliers' die costs. 2) -2.2 billion yen from SG&A expenses. Although freight storage fees and advertising costs increased (by 1.0 billion yen) in FHI, domestic dealers made efforts in reduction of administrative expenses (by 0.1 billion yen). Moreover, in SOA, although advertising costs has increased (by 0.6 billion yen), incentives ($15M, with $2,300 per unit reduced to $1,800 per unit) decreased by 1.8 billion yen, resulting in total change of 1.2 billion yen. However, there were increases in incentives in the Canadian subsidiary (by 0.9 billion yen) and impact of new consolidations (by 1.0 billion yen). 3) -2.2 billion yen from an increase in warranty costs. 4) The remaining -2.0 billion yen came from currency exchange adjustment for purchases in subsidiaries. The loss on currency exchange was -10.4 billion yen in total. US$ brought -10.2 billion yen due to appreciation of yen by about 16 yen. Euro was 0 because of almost no rate differences. Canadian dollar brought -0.2 billion yen with a 6 yen appreciation. The impact of reduction in cost, net of raw material price raise was -0.8 billion yen, comprised of -1.4 billion yen from FHI, and +0.6 billion yen from SIA. This includes a total raise of 3.0 billion yen in raw material costs stemming from a precious metal, oil related parts and others, 2.4 billion yen and 0.6 billion yen from FHI and SIA respectively. As a result of the above, operating income increased by 2.9 billion yen. |