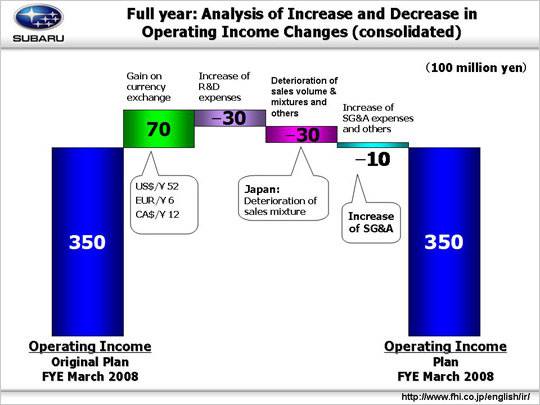

Factors leading to the increase and decrease, although there is no change in the projected operating income of 35.0 billion yen; A 3.0 billion yen increase in R&D expenses (from 53.0 billion yen to 56.0 billion yen) is projected as a decrease of operating income. This amount will be used mainly for improving the environmental performance of new models to be launched. Concentrated efforts will be made toward the development of a vehicle equipped with a diesel engine which will be introduced in Europe next year under the Subaru brand. Another factor contributing to the decrease in operating income is the deterioration of product mix in the domestic market, which is estimated to be 3.0 billion yen. Although sales of the Impreza launched in Japan in June continue to be good, buoyant sales of the Impreza is concerned to have an adverse effect on the sales volume and product mix of other passenger cars. An increase of 1.0 billion yen in SG&A expenses is projected in order to deal with the anticipated decline in the sales volume and product mix while the launch of the Forester in the domestic market is scheduled for the end of this fiscal year. Although we are continuing our cost reduction efforts, we decided that this step is needed to stabilize domestic sales. We are not making any change to the estimated operating income for this fiscal year for the reasons stated above. |