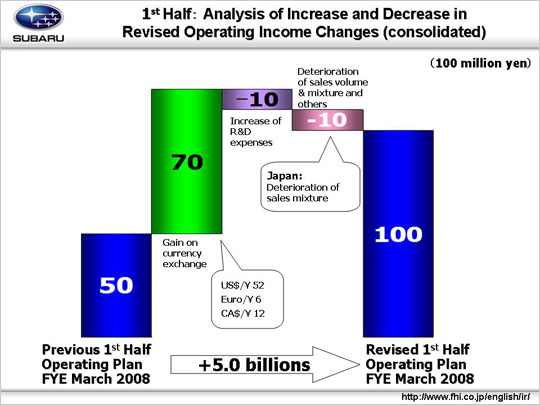

Factors for the upward revision in operating income for the first half from 5.0 billion yen to 10.0 billion yen are;

An increase of 7.0 billion yen is expected from foreign exchange gain. The initially projected market rates were revised based on the current status of the weak yen. There will be a five-yen depreciation against the U.S. dollar (from 115 yen to 120 yen) for an estimated gain of 5.2 billion yen, a seventeen-yen depreciation against the Euro (from 145 yen to 162 yen) for an estimated gain of 0.6 billion yen, and an eleven-yen depreciation against the Canadian dollar (from 100 yen to 111 yen) for an estimated gain of 1.2 billion yen.

Instead of adding these exchange gains to operating income, factors leading to decrease in operating income are projected, including an increase of 1.0 billion yen in R&D expenses and a 1.0 billion yen decrease due to a deterioration of product mix.

The 1.0 billion yen increase in R&D expenses is for improving the environmental performance of new models to be developed, especially models equipped with a diesel engine to be launched next year.

Although the new Impreza launched in June in Japan is enjoying good sales, the 1.0 billion yen decrease in the product mix is concerned in the domestic market during the first half due to the declining sales volume of other passenger cars.

The operating income has been revised upward, adding 5.0 billion yen based on the above analysis.

|