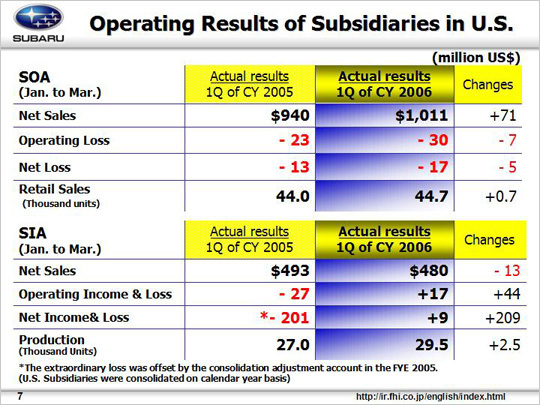

SOA retail sales of the B9 Tribeca and Impreza were good and boosted the total sales volume by approximately 7 hundred units on a year-on-year basis, driving sales up US$71 million. Despite the improved sales volume and mix, operating losses increased by $7 million on a year-on-year basis to $30 million due to a $9.7 million increase in incentives from $1,900 in 1Q/2005 to $2,000 in 1Q/2006 along with an increase in advertising costs. Net losses likewise jumped by $5 million from the same period last year to $17 million.

SIA saw a drop of $13 million in sales due to the deterioration in product mix and decline in production volume for the Legacy could not offset by increase of production volume for the B9 Tribeca. At the profit level there were factors leading to a profit decrease such as increases in the depreciation of dies for the B9 Tribeca and other depreciation costs, which were offset by such positive factors as the improved volume and product mix as a result of the launch of the B9 Tribeca, reduction of overhead costs and expenditures from labor costs and other expenses related to the completion of the B9 Tribeca’s launch. This all resulted in an increase of $44 million to $17 million in operating income. Net income totaled $9 million, with a profit increase of $209 million due to the write-off of extraordinary losses generated from the cancellation of leased facilities as a result of the termination of consignment production as well as impairment losses, which were reported last year.

|