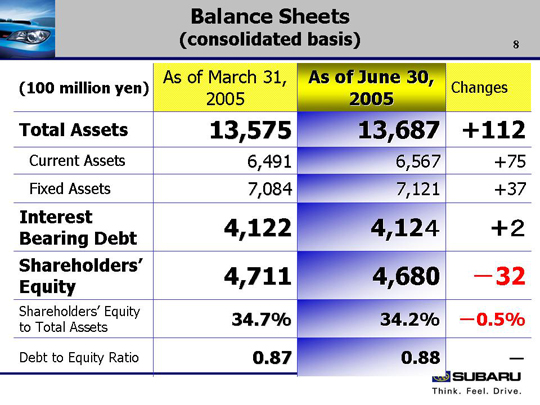

| The balance sheet shows current assets declining in notes and accounts receivable but increasing in inventories. This was due to the fact that domestic dealers collected receivables after sales in March and increased their inventories in time for the bonus season in July when demand increased. SOA and SIA increased their B9 Tribeca inventories toward the end of June. There was a decrease of 2.9 billion yen in machinery and equipment due to depreciation. There was also an increase in long-term deferred tax assets due to tax effect accounting (SIA). As for interest-bearing debt, CP amounting to 6 billion yen was issued by our subsidiary, Subaru Finance. It was transferred from short-term debt, totaling 412.4 billion yen, which remained the same level from the end of the last fiscal year. The debt to equity ratio was 0.88. 0.7 billion yen was amortized for the consolidated adjustment account in relation to SIA’s payment of fixed costs. Shareholders’ equity declined by 3.2 billion yen to 468 billion yen with a decrease of 1.2 billion yen in net income for this period and a decrease of 4.8 billion yen in retained earnings in addition to payment of cash dividends totaling 3.5 billion yen. Shareholder’s equity to total assets dropped 0.5% to 34.2%. |