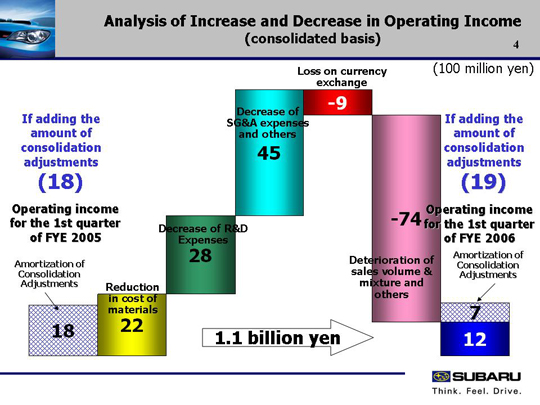

| Here is a detailed analysis of the 1.1 billion yen increase in operating income. Factors leading to profit increase: We achieved a cost reduction of 2.2 billion yen, of which 1.8 billion accounted for Fuji Heavy Industry and 0.4 billion for SIA. We reduced research and development spending by 2.8 billion (from 12.3 to 9.6 billion). We cut 4.5 billion yen in overhead. We saw an increase of 0.1 billion yen in fixed manufacturing costs due to an increase in fixed manufacturing costs associated with of the launch of the new models in SIA, though the effect of FHI’s termination of depreciation of the dies for the Legacy model. We experienced a decrease of 1.2 billion yen in sales, general, and administrative expenses largely due to reduced advertising costs by FHI. We also saw a decrease of 1.2 billion yen in warranty costs (allowances) as well as in other areas. Factors leading to profit decrease: We suffered a foreign exchange loss of 0.9 billion yen, negative 1.5 billion yen against the US dollar, 0.1 billion yen against the Euro and 0.5 billion yen against the Canadian dollar. We experienced a 7.4 billion yen loss due to a deterioration of sales volume and mixture. This amount included a loss of approximately 4 billion yen in domestic sales. This loss was due to a decline in the sales volume and unfavorable sales mixture. Overseas sales dropped by 1 billion yen due to a deterioration of sales mixture. The above loss due to the sales mixture included approximately 2.5 billion yen from models shipped by FHI. These models had improved specifications to meet safety and environmental requirements but such improvements were not reflected in their prices. We saw a loss of approximately 2 billion yen due to inventory adjustment. With all these factors, operating profit increased 1.1 billion yen. |